Transport tax in Ukraine: who pays, how much, and when in 2025

Articles

Table of Contents

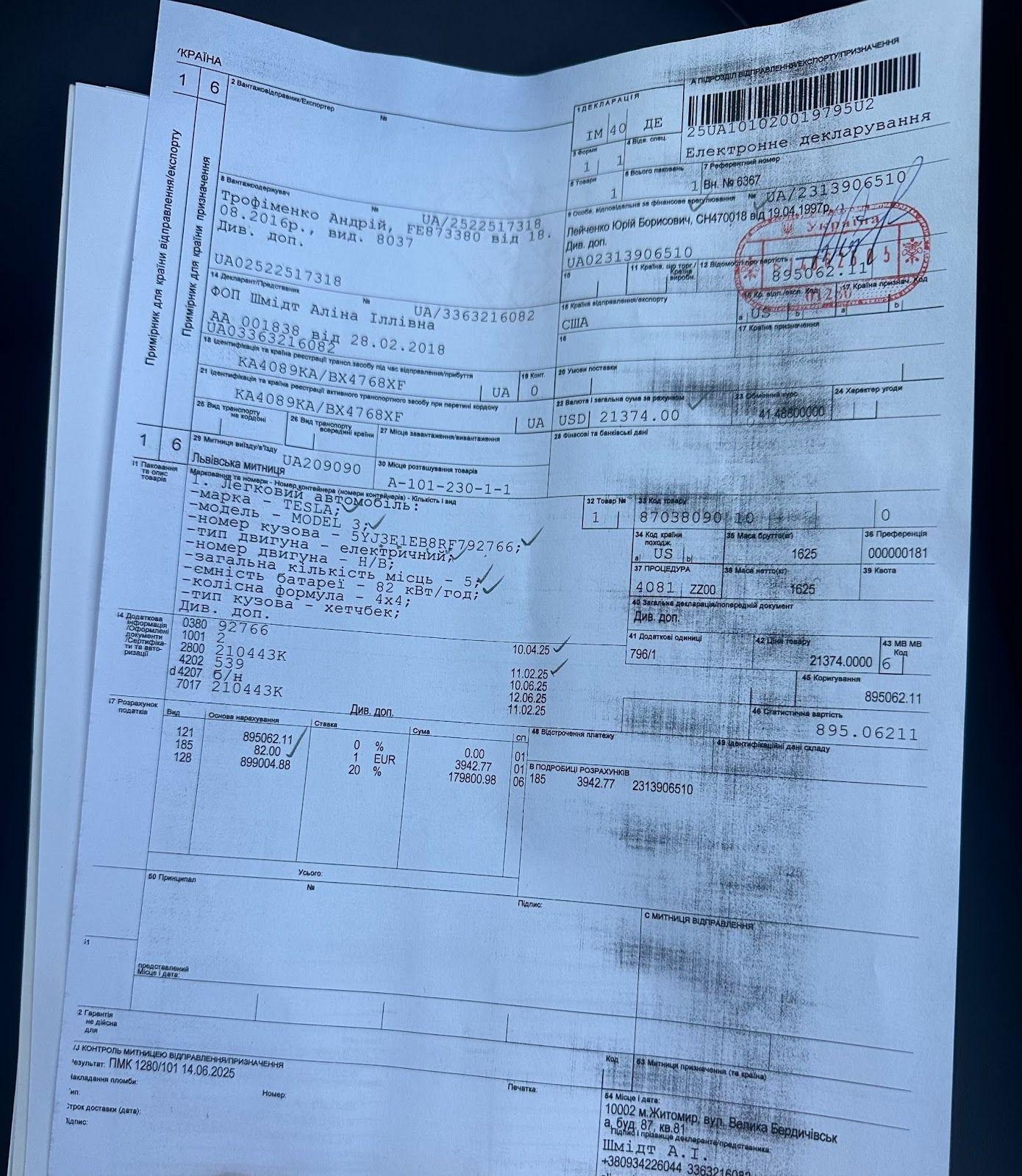

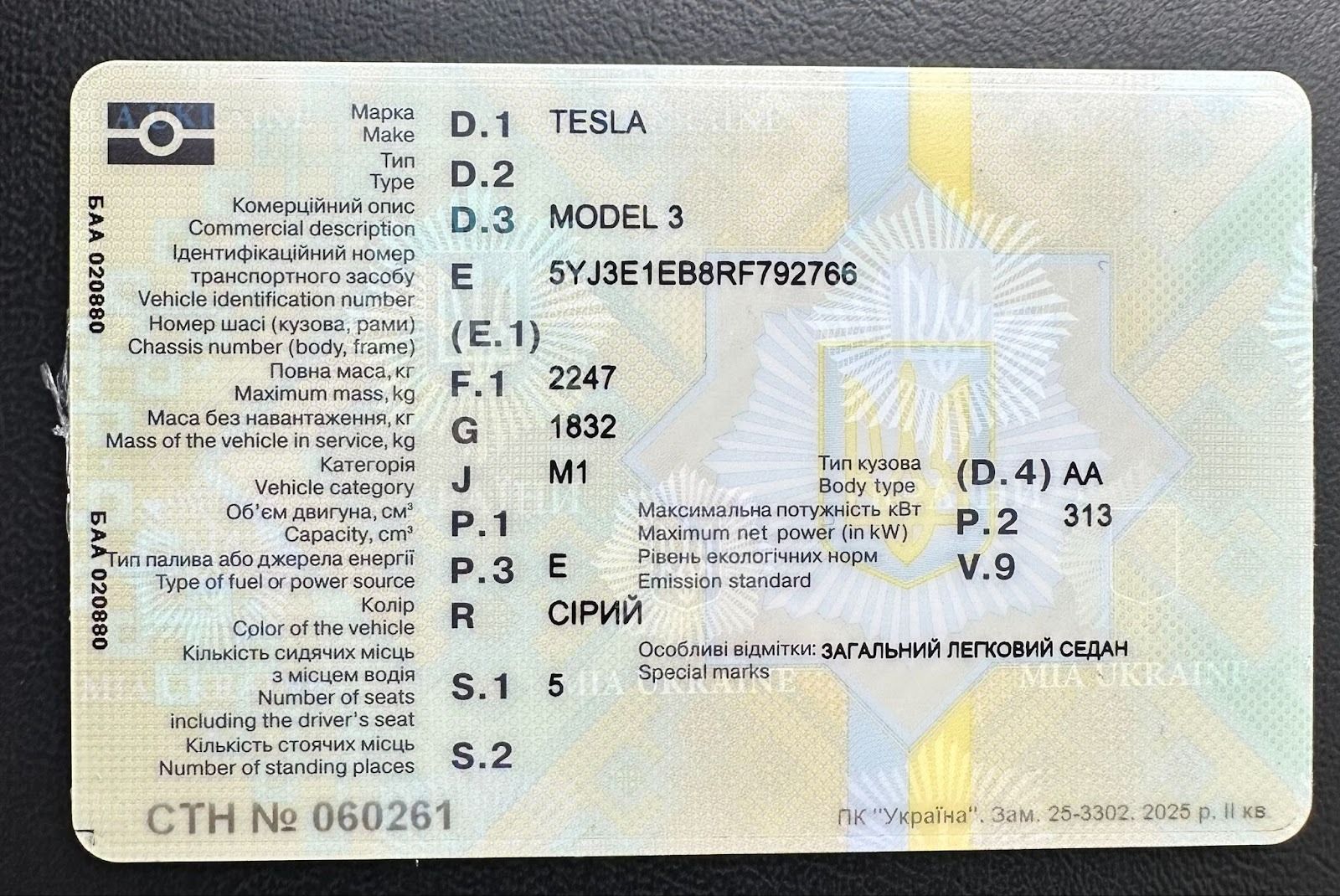

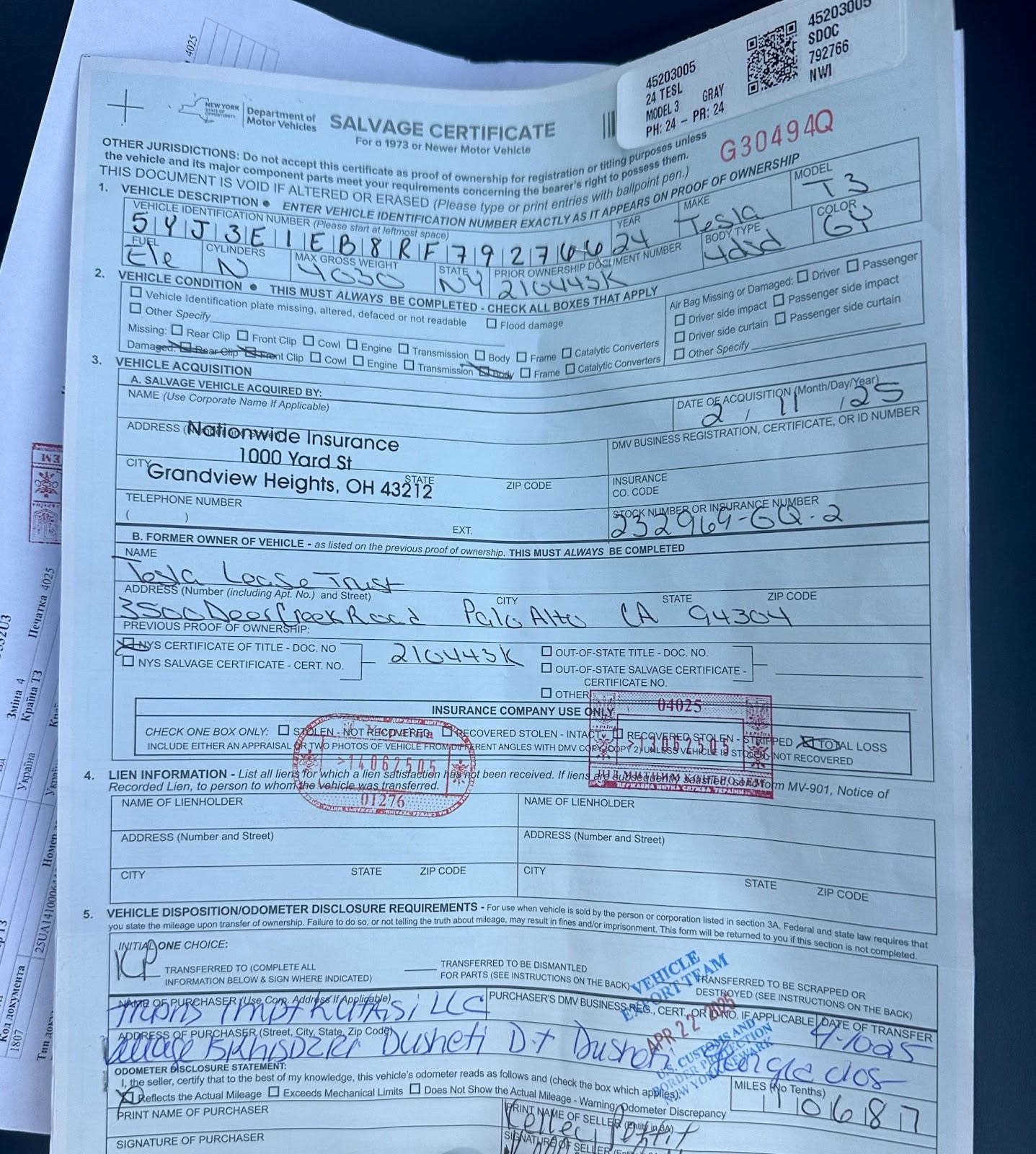

In 2025, Ukraine will implement an updated transport tax payment procedure established by Article 267 of the Code of Ukraine and the annual List of the Ministry of Economy. The tax applies to passenger cars registered in Ukraine, provided they are less than five years old and their estimated average market value exceeds the statutory threshold. The vehicle's origin is irrelevant. If you plan to import a car from the United States and it falls under the luxury vehicle taxation criteria, you will also be required to pay the tax. The Acars team has been assisting clients with the purchase and commissioning of American cars for many years, so below we explain in detail who, when, and how much must pay in 2025, as well as how to plan for the car tax in Ukraine in 2026.

What is transport tax and which vehicles are subject to it?

Transport tax in Ukraine is an annual mandatory payment imposed on owners of passenger cars that the state classifies as expensive. Regulatory requirements are set out in Article 267 of the Tax Code of Ukraine , where subparagraphs 267.2.1–267.2.5 list the criteria by which the taxable object is determined. The procedure for calculating the average market value is established by Methodology No. 66 , approved by Cabinet of Ministers Resolution dated February 18, 2016.

In 2025, the transport tax will apply to passenger cars less than five years old and whose average market value, calculated according to Methodology No. 66, exceeds the state-established threshold of 375 minimum wages. Based on the minimum wage in effect as of January 1, 2025, the price of such a car should be approximately three million hryvnias or higher. In other words, the tax is levied only on cars classified as falling into the upper price segment according to state calculations, regardless of their actual purchase price.

The primary document determining the obligation to pay car tax is not the purchase of an expensive car, but the List of Passenger Cars , which the Ministry of Economy publishes annually before February 1. Based on this document, specific vehicle models are identified as subject to taxation in the current calendar year.

The list is used to calculate transport tax for the relevant calendar year and is used by tax authorities as the basis for determining the range of vehicles subject to taxation. This document is taken into account when calculating liabilities for 2025 and when planning potential taxation in 2026.

Additional features to consider:

- If the vehicle is listed in the List, the obligation to pay applies regardless of the actual transaction price or market offers at the time of purchase;

- If the model is not on the List, you will not have to pay, even if the cost of the car, according to the owner’s calculations, exceeds 375 minimum wages.

You can check whether a specific vehicle is subject to the mandatory payment using the official List of Passenger Cars on the Ministry of Economy website, or use the online calculator on the official website, which includes the make, model, VIN, and other technical specifications of the vehicle.

Who is liable for vehicle tax in Ukraine , and when does the obligation arise?

In Ukraine, every owner of a passenger car that meets the taxable object criteria is obligated to pay vehicle tax , regardless of whether the owner is an individual or an organization. Official registration of ownership of the vehicle is the primary factor, as this fact makes the individual taxpayer. For individuals, the tax office determines the amount and sends a tax notice to their registered address, while legal entities are required to calculate the tax liability themselves and report it in their tax return.

How to pay vehicle tax if the owner has changed?

The obligation to pay arises in the month in which the transfer of ownership is recorded in the state register. If a car is purchased mid-year, a legal entity must file a declaration within 30 days of the transaction, while an individual must wait for the register data to be updated and subsequently notified by the tax authorities.

When selling a car, the annual tax amount is distributed among the owners in proportion to the time of actual ownership:

- the previous owner pays for the period up to the month of alienation;

- new owner, starting from the month of purchase.

This procedure is provided for in subparagraph 267.6.5 of the Tax Code of Ukraine and prevents double accrual.

How to calculate the transport tax amount in 2025?

The car tax in Ukraine is set at a fixed amount: UAH 25,000 per calendar year for each car included in the list of luxury models published annually by the Ministry of Economy. Companies do not make this payment all at once. Legal entities divide it into four equal quarterly installments and transfer UAH 6,250 each at the specified deadlines.

For individuals, the mechanism is different. The tax office at the owner's registered address calculates the amount, issuing a tax notice/decision. After receiving this document, the owner has 60 days to make the required payment.

If the new owner acquires ownership rights not at the beginning of the year, the vehicle tax is calculated only for the actual period of ownership. In this case, a monthly calculation is used: the annual rate is divided by 12 and multiplied by the number of months the vehicle was considered taxable.

For example:

Situation | Accrual period | Number of months | Calculation formula | Total tax amount |

Buying a car in May | June – December | 7 months | 25,000 / 12 × 7 | ≈ 14,583 UAH |

The car turns 5 years old in August | January – July | 7 months | 25,000 / 12 × 7 | ≈ 14,583 UAH |

When to pay car tax in Ukraine and how to get a refund on overpayments?

Individuals receive their vehicle tax assessment by July 1 of the current year, after which they have 60 days to pay. If you haven't received a notification and your vehicle is subject to taxation, we recommend contacting the tax office yourself to avoid penalties.

If a car is sold after the annual tax has been paid, for example, in October, the tax is recalculated proportionally based on the months of actual ownership. The overpayment is refunded via bank transfer or can be retained as a balance to cover future liabilities.

Legal entities calculate their vehicle tax as of January 1 of the reporting year and file a tax return no later than February 20, reporting the annual amount broken down by quarter. Advance payments are made quarterly—by April 30, July 29, October 29, 2025, and January 29, 2026.

Benefits and exemptions for cars in Ukraine

Under the current version of Article 267 of the Tax Code, no special transport tax exemptions are provided for expensive passenger cars included in the Ministry of Economy's annual list. Even if the owner falls into a privileged category (for example, a person with a disability or a combat veteran), the exemption does not apply if the vehicle meets the taxable object criteria.

Exemptions may only apply to vehicles not classified as objects as defined in subparagraph 267.2.1 of the Tax Code. To confirm eligibility for the exemption, the owner must submit an application to the regulatory authority and documents confirming the status and characteristics of the vehicle.

How to prepare for car taxes before buying with Acars?

Before planning your vehicle maintenance expenses, our team always checks whether your car is subject to taxation this year or next. Keep in mind that this requirement also applies to vehicles imported from abroad (the vehicle must be registered in Ukraine). If you're considering buying a car from the US , Acars will not only help with selection and logistics but also provide an advance tax assessment, so you understand the taxes you'll pay when purchasing a used car after registration.

FAQ

What should I do if my car is not on the list, but the tax has been assessed?

This happens due to registry update errors. You must submit a reconciliation request to the regulatory authority and attach a page from the Ministry of Economy's official list for the relevant year. The accrual will be cancelled.

Do I need to pay vehicle tax if the actual price of the vehicle is lower than the List price?

Yes. The tax is calculated based on the average market value determined by the Ministry of Economy, not the actual purchase price. This is the main provision of Article 267 of the Tax Code of Ukraine.

What should I do if my car is listed in the calculator but not on the Ministry of Economy's List?

There is no tax requirement. Only the List published by the Ministry of Economy before February 1 of this year is legally binding. The calculator is for reference only.

Does changing the owner's registration address change anything?

Yes. For individuals, vehicle tax is calculated by the tax office at the taxpayer's registered address. If you change your address, the information is automatically transferred, but it's best to notify the new tax office to ensure your notifications are correctly linked.

Why reconcile data if the notification never arrived?

If the vehicle meets the criteria for a passenger car priced above the threshold, the absence of notification does not exempt you from the obligation to pay. Verification helps avoid penalties and fines.